【Komponentwaan】 Verspreide komponentgidsprys in die 3de week van Mei!

In the third week of May, prices across the photovoltaic industry chain continued to decline. Due to inventory accumulation, silicon cells and silicon materials have dropped below cost prices, with a decline exceeding 30% since the beginning of the year. The solar panel Vane Column provides weekly price analysis for distributed solar panels, serving PV box analysis groups, leading solar panel manufacturers, investors, mainstream EPCs in distributed energy sector, etc., as a reference for market price confirmation this week. This information is provided for reference only and we do not assume responsibility for any market operations or investment advice.

Silica nuutste prys

This week, the overall price decline trend of silicon links continued, except for N-type materials, all fell below 40,000 RMB/ton, the lowest price has come to 31,000 RMB/ton, and the average price has fallen by 9.16%.

Volgens die opsporingsdata wat op 15 Mei deur die Silicon Chapter vrygestel is:

The transaction price of N-type materials was 41-45,000 RMB/ton, and the average price came to 43,000 RMB/ton, down 5.08% from before the festival;

The transaction price of single crystal recharging is 36,000-41,000 RMB/ton, with an average price of 38,600 RMB/ton, down 5.85% compared with before the festival;

Die transaksieprys van enkelkristal kompakte materiaal was 34 000 tot 39 000 RMB/ton, met 'n gemiddelde prys van 37 300 RMB/ton, 4,36% laer vergeleke met voor die fees;

The transaction price of single crystal cauliflower material was 31-36,000 RMB/ton, with an average price of 33,700 RMB/ton, down 9.16% compared with before the festival;

N-tipe korrelsilikon het teen 37 000-39 000 RMB/ton verhandel, met 'n gemiddelde prys van 37 500 RMB/ton, 6,25% laer as voor die fees.

Van die vraagkant af het die huidige terminale vraag nog nie herstel nie, silikonvoorraad bly ophoop, silikonpryse bly daal en silikonverkrygingsbegrotings word verder verminder;

From the supply side, the current price of less than 4 RMB has fallen below the cash cost of most silicon companies (the cash cost of silicon leads in 2023 is more than 40 RMB/kg). And the raw material end silicon powder and industrial silicon prices tend to be stable, silicon material production costs are difficult to compress. To sum up, the current silicon production enterprises are facing a loss of sales situation, low prices are concentrated in new and cash flow difficulties manufacturers, most manufacturers have used production maintenance, production cuts and other ways to deal with the bottom price, silicon supply from this month will be reduced.

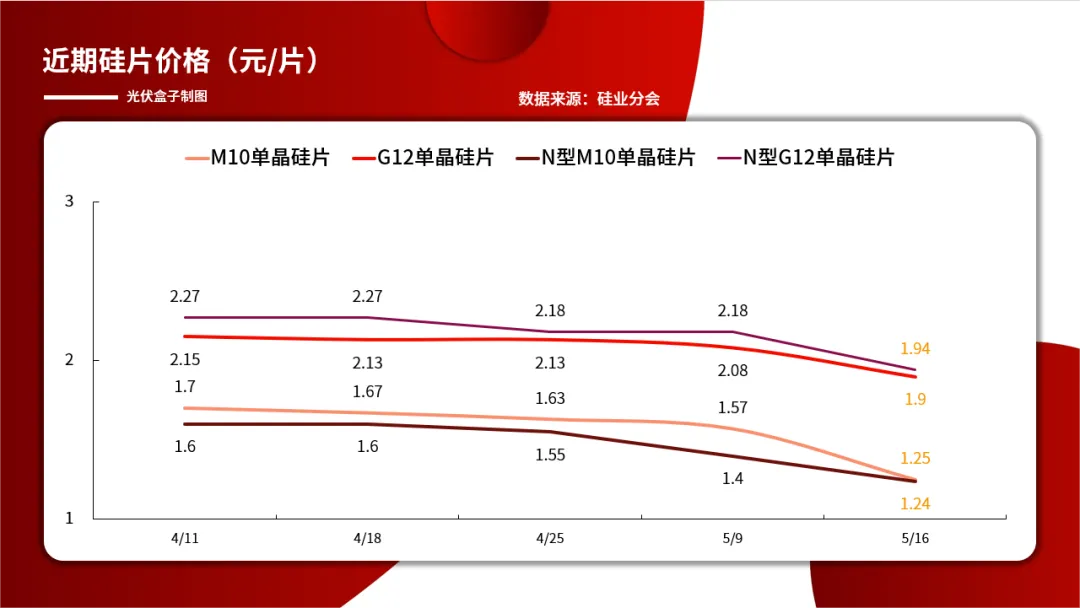

Die jongste prys van silikon sel

Die daling in silikonpryse beïnvloed ook steeds die tendens van silikonskyfiepryse. Volgens die opsporingsdata wat op 16 Mei deur die Silicon Industry Tak vrygestel is, is die laagste prys in die silikonmark hierdie week het op 12 000 RMB/ton gekom, en die gemiddelde prys het gedaal 20.4%.

Die gemiddelde transaksieprys van P-tipe M10 monokristallyne silikonsel was 1,25 RMB/sel, af 20.4% in vergelyking met dit voor die fees;

Die gemiddelde transaksieprys van N-tipe M10 monokristallyne silikonsel was 1,24 RMB/sel, af 11.4% in vergelyking met dit voor die fees;

Die gemiddelde transaksieprys van P-tipe G12 monokristallyne silikonsel is 1,9 RMB/sel, af 8.65% van verlede week;

N-tipe G12 monokristallyne silikonsel transaksie gemiddelde prys van 1,94 RMB/stuk, laer 11% van verlede week af.

Ontleding van die redes vir die skerp daling in silikon skakel pryse hierdie week, hoofsaaklik die huidige silikon skakel voorraad het nog nie gesien duidelike effekte, stroomaf koop silikon entoesiasme is beperk, onderneming bied en gestuur superposisie stroomop silikon materiaal pryse bly daal, silikon transaksie pryse het skerp gedaal.

Dit word verstaan dat die kontantverlies van silikonselondernemings tans ernstiger is, en sommige vervaardigers gaan voort om produksie te verminder. Volgens die Silicon Industry-takopname het die twee voorste ondernemings en geïntegreerde ondernemings vandeesweek die bedryfskoers aansienlik verlaag. Geïntegreerde ondernemings is baie meer koste-effektief as hul eie produksie van silikonselle, daarom neem hulle silikongietery, dubbelverspreiding, direkte mynbou en ander maniere van bedryf aan.

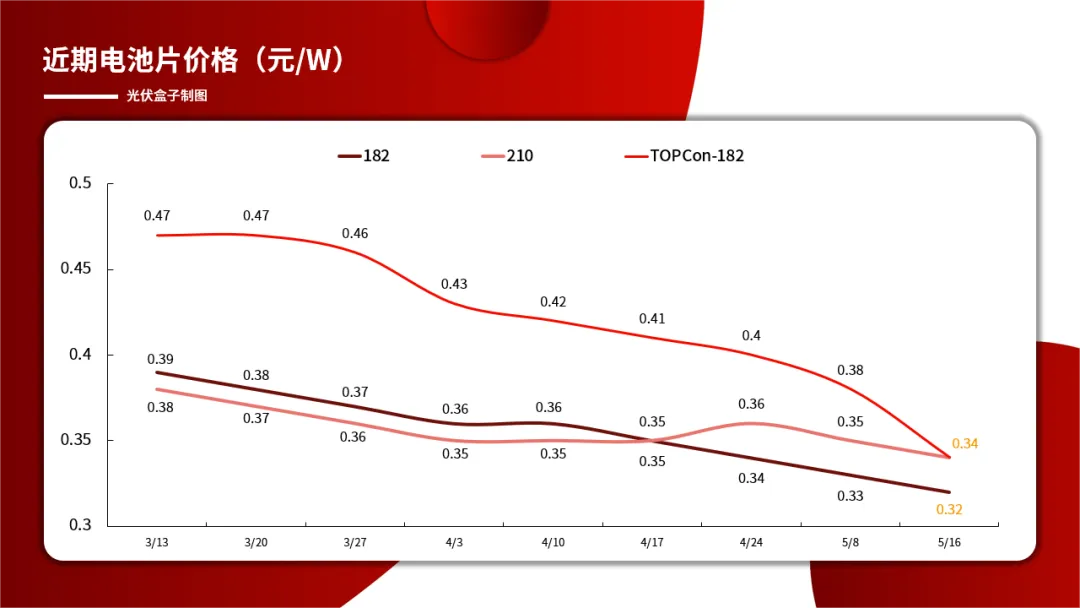

Die jongste prys van sel

Cell prices continued to fall this week, and TOPCon cell prices fell more.

At present, the price of N-type TOPCon cell has come to 0.34 RMB /W; The price of single crystal PERC182 cell came to 0.32 RMB /W, and the price of single crystal PERC210 cell came to 0.34 RMB /W.

This week, the supply pressure of the cell segment continues to increase, on the one hand, the N-type output continues to grow, on the other hand, the upstream silicon chip overfalls lead to the downstream limit price pressure, and the inventory continues to rise. In addition, the chaos in the price of silicon chips has exacerbated the discrete cost of cell chips and the confusion in the market quotation. It is understood that some manufacturers are already planning to reduce production.

Looking forward to the future trend, if the upstream price continues to overfall, it is expected that the cell price still has room to explore.

Die nuutste prys van Sonpaneel

This week, the solar panel market was affected by the upstream, and the price continued to fall.

According to market data, in the distributed range this week, the mainstream trading price of first-line 182 single-sided single crystal PERC solar panels was 0.8-0.84 RMB/W, with an average price of 0.82 RMB /W; The mainstream price of 182 PERC double glass solar panels is 0.82-0.86 RMB /W, with an average price of 0.84RMB /W; The 210 series is the same price.

In terms of N-type solar panels, within the distributed range this week, the mainstream price of TOPCon solar panel orders delivered by first-line enterprises is in the range of 0.84-0.92 RMB /W, with an average price of 0.86 RMB /W; The mainstream trading price of HJT solar panel manufacturers has fallen to the range of 0.97-1.1 RMB /W, with an average price of 1 RMB /W.

Uit die oogpunt van vraag en aanbod was die algehele vraag en aanbod van sonpanele hierdie week stabiel. Aan die aanbodkant het die irrasionele en vinnige daling van stroomoppryse egter 'n wesenlike impak op die sy-ondersteuning van sonpaneelkoste gehad, so vervaardigers pas pryse aan; Aan die vraagkant is die inkomste van die terminale projek beter, maar die voortgesette oorval van stroomoppryse laat die terminale ook twyfel of die sonpaneelprys stabiel kan wees. Oor die algemeen was daar nie 'n groot verandering in die sterkte van sonpaneellewering hierdie week nie.

Pv box PV stroomaf markgroep gebaseer op die transaksieprys van verspreide mark sonpanele in die terminale statistieke, die gidsprys van sonpanele in die derde week van Mei word soos volg opgesom:

Let wel

1. Die prys wat vir hierdie week se sonpanele gekwoteer word, is die gidsprys vir verspreide projek sonpanele met die aankoopvolume van 1MW vanaf plek, insluitend 13% belasting op toegevoegde waarde en vrag in Oos-China (nie as verwysing vir grootskaalse bod) projekte).

- 2.Die prys van hierdie sonpaneel is 'n verwysing na die marktransaksieprys van die eerstelyn sonpaneelfabriek. Die prys van die tweedelyn sonpaneelfabriek is oor die algemeen 0,02-0,04 RMB /W goedkoper as dié van die eerstelyn sonpaneelfabriek.

3.die 1MW-verspreide PV-module-gidsprys is slegs vir verspreide beleggers en EPC-verwysing

-

String Solar Inverter: The High-Efficiency Solution for Smart Solar EnergyNuusJul.14,2025

-

Revolutionizing Rooftop Energy with the Power of the Micro Solar InverterNuusJul.14,2025

-

Power Independence with Smart Off Grid Solar Inverter SolutionsNuusJul.14,2025

-

On Grid Solar Inverter: Powering the Future with Smart Grid IntegrationNuusJul.14,2025

-

Monocrystalline Solar Panels: High-Efficiency Power for the Future of Clean EnergyNuusJul.14,2025

-

Bifacial Solar Panel: A Smarter Investment for Next-Generation Energy SystemsNuusJul.14,2025