【 Component vane 】 Distributed component guide price in the 3rd week of May!

In the third week of May, prices across the photovoltaic industry chain continued to decline. Due to inventory accumulation, silicon cells and silicon materials have dropped below cost prices, with a decline exceeding 30% since the beginning of the year. The solar panel Vane Column provides weekly price analysis for distributed solar panels, serving PV box analysis groups, leading solar panel manufacturers, investors, mainstream EPCs in distributed energy sector, etc., as a reference for market price confirmation this week. This information is provided for reference only and we do not assume responsibility for any market operations or investment advice.

Silica latest price

This week, the overall price decline trend of silicon links continued, except for N-type materials, all fell below 40,000 RMB/ton, the lowest price has come to 31,000 RMB/ton, and the average price has fallen by 9.16%.

According to the tracking data released by the Silicon Chapter on May 15:

The transaction price of N-type materials was 41-45,000 RMB/ton, and the average price came to 43,000 RMB/ton, down 5.08% from before the festival;

The transaction price of single crystal recharging is 36,000-41,000 RMB/ton, with an average price of 38,600 RMB/ton, down 5.85% compared with before the festival;

The transaction price of single crystal compact material was 34,000 to 39,000 RMB/ton, with an average price of 37,300 RMB/ton, down 4.36% compared with before the festival;

The transaction price of single crystal cauliflower material was 31-36,000 RMB/ton, with an average price of 33,700 RMB/ton, down 9.16% compared with before the festival;

N-type granular silicon traded at 37,000-39,000 RMB/ton, with an average price of 37,500 RMB/ton, down 6.25% from before the festival.

From the demand side, the current terminal demand has not yet recovered, silicon inventory continues to accumulate, silicon prices continue to decline, and silicon procurement budgets are further reduced;

From the supply side, the current price of less than 4 RMB has fallen below the cash cost of most silicon companies (the cash cost of silicon leads in 2023 is more than 40 RMB/kg). And the raw material end silicon powder and industrial silicon prices tend to be stable, silicon material production costs are difficult to compress. To sum up, the current silicon production enterprises are facing a loss of sales situation, low prices are concentrated in new and cash flow difficulties manufacturers, most manufacturers have used production maintenance, production cuts and other ways to deal with the bottom price, silicon supply from this month will be reduced.

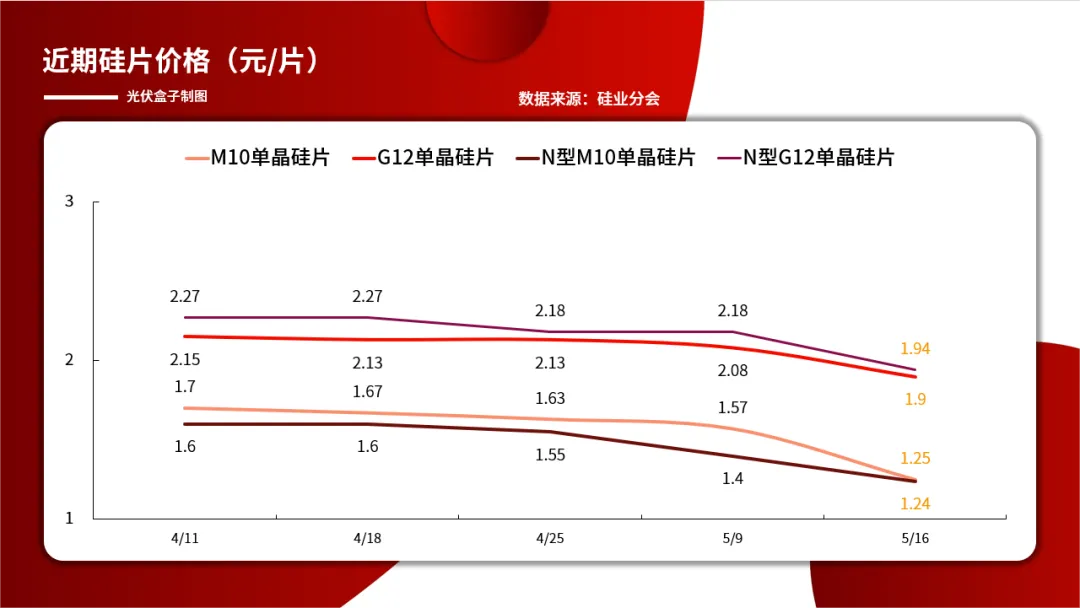

The latest price of silicon cell

The decline in silicon prices also continues to affect the trend of silicon chip prices. According to the tracking data released by the Silicon Industry Branch on May 16, the lowest price in the silicon market this week has come to 12,000 RMB/ton, and the average price has plummeted by 20.4%.

The average transaction price of P-type M10 monocrystalline silicon cell was 1.25 RMB/cell, down 20.4% compared with that before the festival;

The average transaction price of N-type M10 monocrystalline silicon cell was 1.24 RMB/cell, down 11.4% compared with that before the festival;

The average transaction price of P-type G12 monocrystalline silicon cell is 1.9 RMB/cell,down 8.65% from last week;

N-type G12 monocrystalline silicon cell transaction average price of 1.94 RMB/piece, down 11% from last week.

Analysis of the reasons for the sharp drop in silicon link prices this week, mainly the current silicon link inventory has not yet seen obvious effects, downstream buying silicon enthusiasm is limited, enterprise bidding and shipping superposition upstream silicon material prices continue to decline, silicon transaction prices fell sharply.

It is understood that at present, the cash loss of silicon cell enterprises is more serious, and some manufacturers continue to reduce production. According to the Silicon Industry branch survey, this week the two leading enterprises and integrated enterprises significantly reduced the operating rate. Integrated enterprises are much more cost-effective than their own production of silicon cells, so they adopt silicon foundry, double distribution, direct mining and other ways of operation.

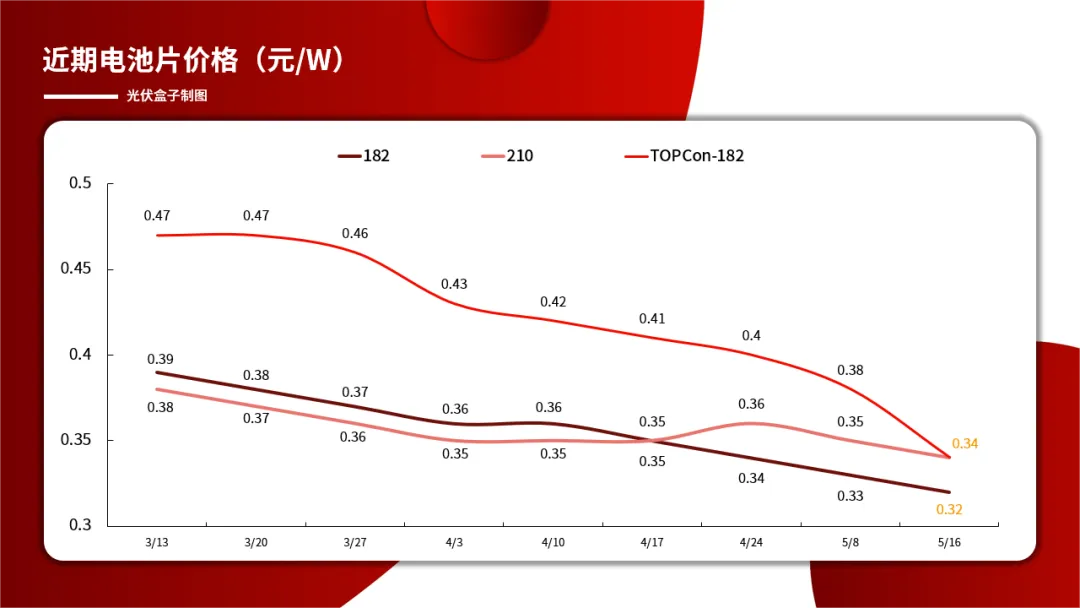

The Latest Price of Cell

Cell prices continued to fall this week, and TOPCon cell prices fell more.

At present, the price of N-type TOPCon cell has come to 0.34 RMB /W; The price of single crystal PERC182 cell came to 0.32 RMB /W, and the price of single crystal PERC210 cell came to 0.34 RMB /W.

This week, the supply pressure of the cell segment continues to increase, on the one hand, the N-type output continues to grow, on the other hand, the upstream silicon chip overfalls lead to the downstream limit price pressure, and the inventory continues to rise. In addition, the chaos in the price of silicon chips has exacerbated the discrete cost of cell chips and the confusion in the market quotation. It is understood that some manufacturers are already planning to reduce production.

Looking forward to the future trend, if the upstream price continues to overfall, it is expected that the cell price still has room to explore.

The latest price of Solar Panel

This week, the solar panel market was affected by the upstream, and the price continued to fall.

According to market data, in the distributed range this week, the mainstream trading price of first-line 182 single-sided single crystal PERC solar panels was 0.8-0.84 RMB/W, with an average price of 0.82 RMB /W; The mainstream price of 182 PERC double glass solar panels is 0.82-0.86 RMB /W, with an average price of 0.84RMB /W; The 210 series is the same price.

In terms of N-type solar panels, within the distributed range this week, the mainstream price of TOPCon solar panel orders delivered by first-line enterprises is in the range of 0.84-0.92 RMB /W, with an average price of 0.86 RMB /W; The mainstream trading price of HJT solar panel manufacturers has fallen to the range of 0.97-1.1 RMB /W, with an average price of 1 RMB /W.

From the perspective of supply and demand, the overall supply and demand of solar panels this week was stable. However, on the supply side, the irrational and rapid decline of upstream prices has had a substantial impact on the side support of solar panel costs, so manufacturers adjust prices; On the demand side, the terminal project income is better, but the continued overfall of upstream prices also makes the terminal doubt whether the solar panel price can be stable. Overall, there has not been a big change in the strength of solar panel delivery this week.

Pv box PV downstream market group based on the transaction price of distributed market solar panels in the terminal statistics, the guide price of solar panels in the third week of May is summarized as follows:

Note

1.The price quoted for this week's solar panels is the guide price for distributed project solar panels with the purchase volume of 1MW from spot, including 13% value-added tax and freight in East China (not as a reference for large-scale bidding projects).

- 2.The price of this solar panel is a reference to the market transaction price of the first-line solar panel factory. The price of the second-line solar panel factory is generally 0.02-0.04 RMB /W cheaper than that of the first-line solar panel factory.

3.the 1MW distributed PV module guide price is only for distributed investors and EPC reference

-

String Solar Inverter: The High-Efficiency Solution for Smart Solar EnergyNewsJul.14,2025

-

Revolutionizing Rooftop Energy with the Power of the Micro Solar InverterNewsJul.14,2025

-

Power Independence with Smart Off Grid Solar Inverter SolutionsNewsJul.14,2025

-

On Grid Solar Inverter: Powering the Future with Smart Grid IntegrationNewsJul.14,2025

-

Monocrystalline Solar Panels: High-Efficiency Power for the Future of Clean EnergyNewsJul.14,2025

-

Bifacial Solar Panel: A Smarter Investment for Next-Generation Energy SystemsNewsJul.14,2025