【 Component vane Distributa component pretium in 3 septimana Maii!

In the third week of May, prices across the photovoltaic industry chain continued to decline. Due to inventory accumulation, silicon cells and silicon materials have dropped below cost prices, with a decline exceeding 30% since the beginning of the year. The solar panel Vane Column provides weekly price analysis for distributed solar panels, serving PV box analysis groups, leading solar panel manufacturers, investors, mainstream EPCs in distributed energy sector, etc., as a reference for market price confirmation this week. This information is provided for reference only and we do not assume responsibility for any market operations or investment advice.

Silica tardus pretium

This week, the overall price decline trend of silicon links continued, except for N-type materials, all fell below 40,000 RMB/ton, the lowest price has come to 31,000 RMB/ton, and the average price has fallen by 9.16%.

Iuxta semitam datam a Capitulo Pii emissi die 15 mensis Maii.

The transaction price of N-type materials was 41-45,000 RMB/ton, and the average price came to 43,000 RMB/ton, down 5.08% from before the festival;

The transaction price of single crystal recharging is 36,000-41,000 RMB/ton, with an average price of 38,600 RMB/ton, down 5.85% compared with before the festival;

Pretium transactionis materiae unius crystalli pacti erat 34,000 ad 39,000 RMB/ton, cum mediocris pretii 37,300 RMB/ton, descendit 4.36% cum ante diem festum;

The transaction price of single crystal cauliflower material was 31-36,000 RMB/ton, with an average price of 33,700 RMB/ton, down 9.16% compared with before the festival;

N-typus granularis siliconis RMB/ton, cum mediocris pretii 37,000-39,000 RMB/ton, venditus 37,500 RMB/ton, descendit 6.25% ante diem festum.

Ex parte postulantis, postulatio terminalis hodierna nondum recepta, inventarium silicon cumulare pergit, pretiis siliconibus declinare pergunt, et rationes procurationis pii adhuc deminutae sunt;

From the supply side, the current price of less than 4 RMB has fallen below the cash cost of most silicon companies (the cash cost of silicon leads in 2023 is more than 40 RMB/kg). And the raw material end silicon powder and industrial silicon prices tend to be stable, silicon material production costs are difficult to compress. To sum up, the current silicon production enterprises are facing a loss of sales situation, low prices are concentrated in new and cash flow difficulties manufacturers, most manufacturers have used production maintenance, production cuts and other ways to deal with the bottom price, silicon supply from this month will be reduced.

Aliquam vitae pretium risus cellula

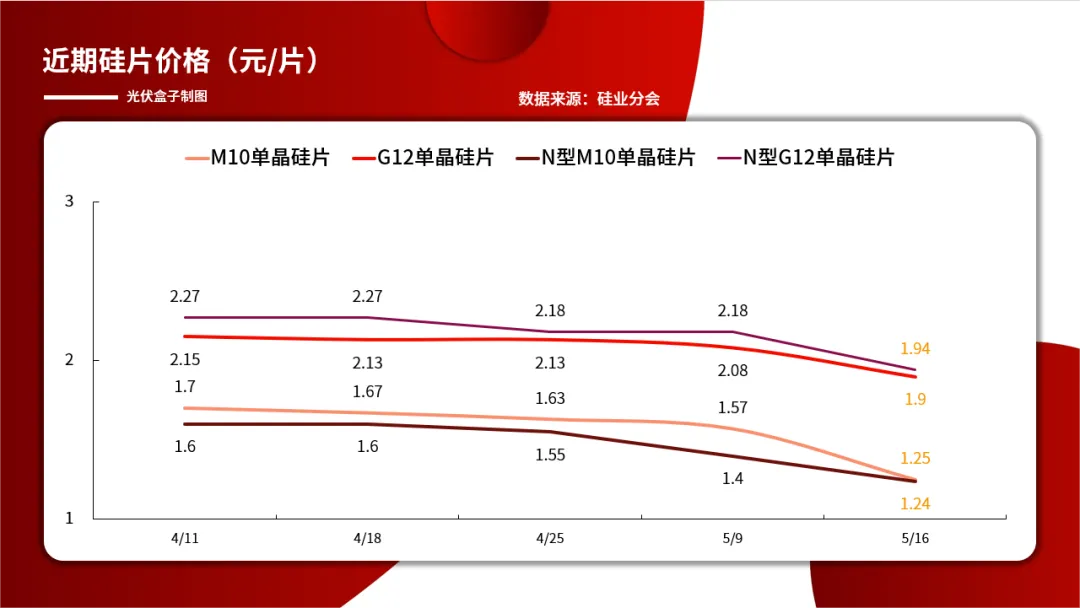

Pretium Pii declinatio etiam pergit inclinatio pretii chip siliconis afficere. Iuxta semitam datam a Siliconis Industry emissam germen die 16 mensis Maii pretium pretium in foro Pii hac septimana venit ad 12000 RMB/tonac mediocris pretii plummet 20.4%.

In mediocris pretium transaction P-type M10 cellulae siliconicae monocrystallini was 1.25 RMB/cell, descendit 20.4% cum illo ante diem festum ;

In mediocris pretium transaction N-type M10 cellulae siliconicae monocrystallini was 1.24 RMB/cell, Descendit 11.4% cum illo ante diem festum ;

In mediocris pretium transaction P-type G12 cellulae siliconicae monocrystallini is 1.9 RMB/cell, deorsum 8.65% de hebdomade proxima;

N-type G12 cellae siliconicae monocrystallini transaction mediocris pretium 1.94 RMB / fragmen, deorsum 11% de sabbato prox.

Analysis causarum guttae acutae in paginae siliconis pretiis huius hebdomadis, principaliter inventarii nexus Siliconis currentis nondum effectus manifestos vidimus, amni ementes pii ardoris limitantur, incepti iubentes et naviculae superpositionis fluminis Pii materialia pretia declinare pergunt, res Pii gestae sunt. pretium cecidit acriter.

Intelligitur in praesens, nummi amissionem inceptis cellulis siliconis graviorem esse, et aliquos artifices ad productionem reducendam pergere. Secundum Ramum Industry Silicon percontatio, hac septimana duo inceptis principalibus et inceptis integratis signanter rate operantem redegerunt. Incepta integrae multo magis cost-efficaces sunt quam propriae cellularum siliconum productione, ideoque fundationem pii, duplicem distributionem, fodienda aliaque operandi vias dirigunt.

Tardus Price of Cell

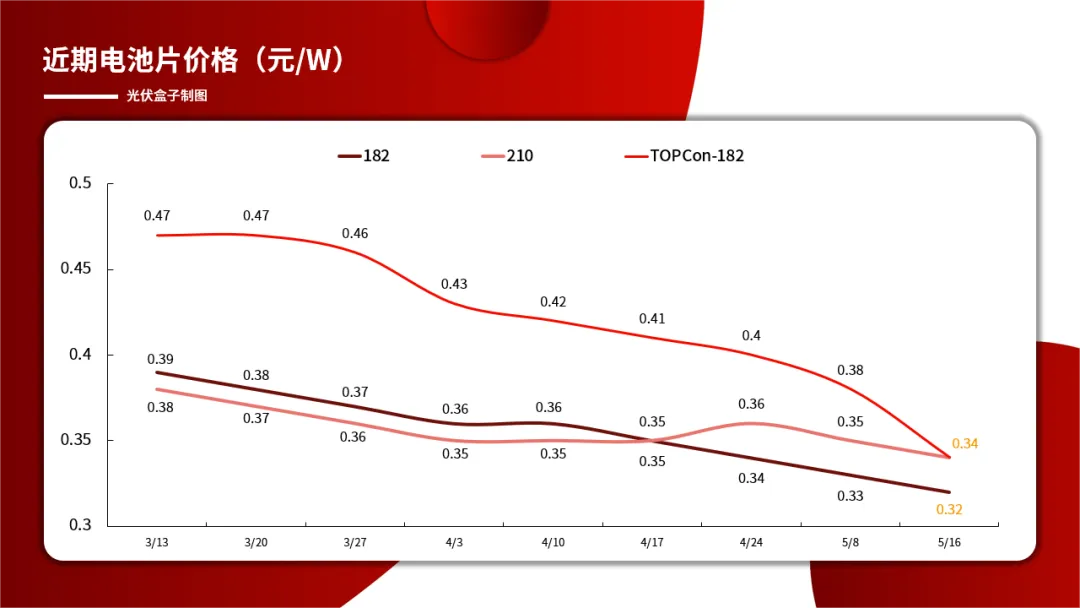

Cell prices continued to fall this week, and TOPCon cell prices fell more.

At present, the price of N-type TOPCon cell has come to 0.34 RMB /W; The price of single crystal PERC182 cell came to 0.32 RMB /W, and the price of single crystal PERC210 cell came to 0.34 RMB /W.

This week, the supply pressure of the cell segment continues to increase, on the one hand, the N-type output continues to grow, on the other hand, the upstream silicon chip overfalls lead to the downstream limit price pressure, and the inventory continues to rise. In addition, the chaos in the price of silicon chips has exacerbated the discrete cost of cell chips and the confusion in the market quotation. It is understood that some manufacturers are already planning to reduce production.

Looking forward to the future trend, if the upstream price continues to overfall, it is expected that the cell price still has room to explore.

The tardus pretium Solaris Panel

This week, the solar panel market was affected by the upstream, and the price continued to fall.

According to market data, in the distributed range this week, the mainstream trading price of first-line 182 single-sided single crystal PERC solar panels was 0.8-0.84 RMB/W, with an average price of 0.82 RMB /W; The mainstream price of 182 PERC double glass solar panels is 0.82-0.86 RMB /W, with an average price of 0.84RMB /W; The 210 series is the same price.

In terms of N-type solar panels, within the distributed range this week, the mainstream price of TOPCon solar panel orders delivered by first-line enterprises is in the range of 0.84-0.92 RMB /W, with an average price of 0.86 RMB /W; The mainstream trading price of HJT solar panel manufacturers has fallen to the range of 0.97-1.1 RMB /W, with an average price of 1 RMB /W.

Ex prospectu copiae et exigentiae, summa copia et postulatio tabularum solarium hac septimana stabilis fuit. Attamen in copia laterali, pretiis fluminis irrationalis et celeri declinatio substantialem ictum in parte subsidii tabulae solaris sumptibus habuit, ut artifices pretia componant; In parte postulante, reditus consilii terminalis melior est, sed continua pretiis fluminis ruina etiam dubitationem facit terminalem num pretium tabulae solaris stabilis esse possit. Super, magna mutatio in viribus tabulae solaris hac septimana traditionis non fuit.

Pv arca PV fori amni coetus secundum transactionem pretium fori solaris in statisticis terminalibus tabularum distributarum, dux pretium tabularum solaris in tertia septimana Maii summatim comprehenditur sic:

Nota

1. Pretium tabulae solaris huic septimanae allatum est dux pretium pro tabulas solares distributas cum volumine emptionis 1MW e macula, incluso 13% valore addito tributo et onerario in Sinis Orientalibus (non ut referuntur ad iussum magnum-scalarum. coepta).

- 2. Pretium huius tabulae solaris refertur ad pretium transactionis mercatus primae fabricae tabulae solaris. Pretium secundae-lineae officinas tabulae solaris plerumque 0.02-0.04 RMB /W vilius est quam officinas tabulae primae lineae solaris.

3.the 1MW distributus PV moduli dux pretium solum ad obsides distribuendos et referendum EPC

-

String Solar Inverter: The High-Efficiency Solution for Smart Solar EnergyNewsJul.14,2025

-

Revolutionizing Rooftop Energy with the Power of the Micro Solar InverterNewsJul.14,2025

-

Power Independence with Smart Off Grid Solar Inverter SolutionsNewsJul.14,2025

-

On Grid Solar Inverter: Powering the Future with Smart Grid IntegrationNewsJul.14,2025

-

Monocrystalline Solar Panels: High-Efficiency Power for the Future of Clean EnergyNewsJul.14,2025

-

Bifacial Solar Panel: A Smarter Investment for Next-Generation Energy SystemsNewsJul.14,2025