【 Baling komponen 】 Harga panduan komponen yang diedarkan pada minggu ke-3 bulan Mei!

In the third week of May, prices across the photovoltaic industry chain continued to decline. Due to inventory accumulation, silicon cells and silicon materials have dropped below cost prices, with a decline exceeding 30% since the beginning of the year. The solar panel Vane Column provides weekly price analysis for distributed solar panels, serving PV box analysis groups, leading solar panel manufacturers, investors, mainstream EPCs in distributed energy sector, etc., as a reference for market price confirmation this week. This information is provided for reference only and we do not assume responsibility for any market operations or investment advice.

Silika harga terkini

This week, the overall price decline trend of silicon links continued, except for N-type materials, all fell below 40,000 RMB/ton, the lowest price has come to 31,000 RMB/ton, and the average price has fallen by 9.16%.

Menurut data penjejakan yang dikeluarkan oleh Silicon Chapter pada 15 Mei:

The transaction price of N-type materials was 41-45,000 RMB/ton, and the average price came to 43,000 RMB/ton, down 5.08% from before the festival;

The transaction price of single crystal recharging is 36,000-41,000 RMB/ton, with an average price of 38,600 RMB/ton, down 5.85% compared with before the festival;

Harga urus niaga bahan padat kristal tunggal ialah 34,000 hingga 39,000 RMB/tan, dengan harga purata 37,300 RMB/tan, turun 4.36% berbanding sebelum perayaan;

The transaction price of single crystal cauliflower material was 31-36,000 RMB/ton, with an average price of 33,700 RMB/ton, down 9.16% compared with before the festival;

Silikon berbutir jenis N didagangkan pada 37,000-39,000 RMB/tan, dengan harga purata 37,500 RMB/tan, turun 6.25% berbanding sebelum perayaan.

Dari segi permintaan, permintaan terminal semasa masih belum pulih, inventori silikon terus terkumpul, harga silikon terus menurun, dan belanjawan perolehan silikon dikurangkan lagi;

From the supply side, the current price of less than 4 RMB has fallen below the cash cost of most silicon companies (the cash cost of silicon leads in 2023 is more than 40 RMB/kg). And the raw material end silicon powder and industrial silicon prices tend to be stable, silicon material production costs are difficult to compress. To sum up, the current silicon production enterprises are facing a loss of sales situation, low prices are concentrated in new and cash flow difficulties manufacturers, most manufacturers have used production maintenance, production cuts and other ways to deal with the bottom price, silicon supply from this month will be reduced.

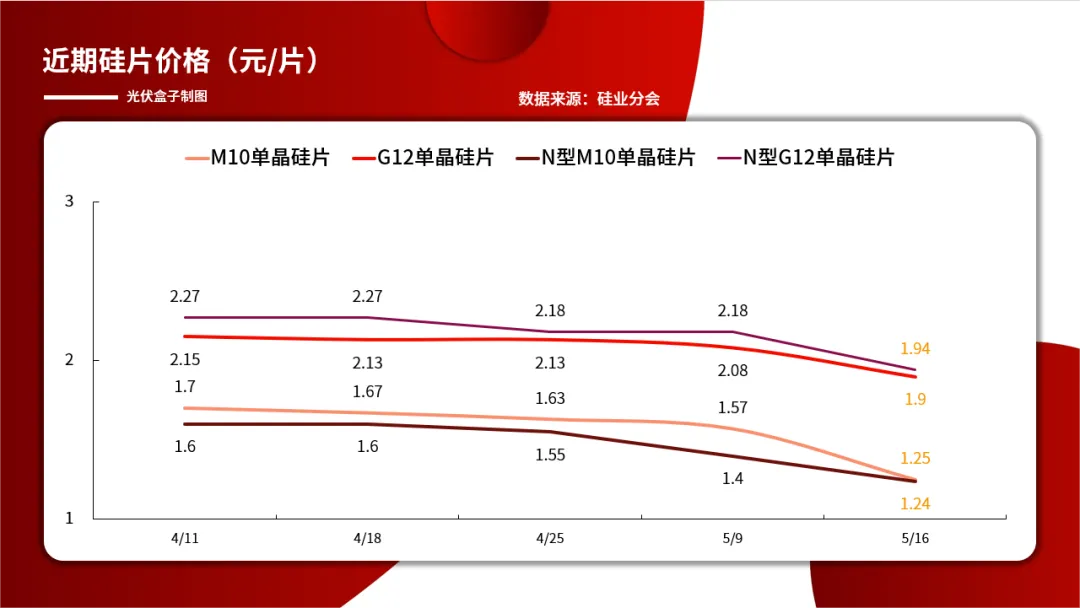

Harga silikon terkini sel

Penurunan harga silikon juga terus menjejaskan trend harga cip silikon. Menurut data penjejakan yang dikeluarkan oleh Cawangan Industri Silikon pada 16 Mei, pihak harga terendah dalam pasaran silikon minggu ini telah mencecah 12,000 RMB/tan, dan harga purata telah menjunam sebanyak 20.4%.

Harga transaksi purata bagi Sel silikon monohabluran M10 jenis P adalah 1.25 RMB/sel, turun 20.4% berbanding sebelum raya;

Harga transaksi purata bagi Sel silikon monohabluran M10 jenis N adalah 1.24 RMB/sel, turun 11.4% berbanding sebelum raya;

Harga transaksi purata bagi Sel silikon monohablur G12 jenis P ialah 1.9 RMB/sel, turun 8.65% dari minggu lepas;

Sel silikon monohabluran G12 jenis N harga purata transaksi sebanyak 1.94 RMB/keping, turun 11% dari minggu lepas.

Analisis sebab penurunan mendadak harga pautan silikon minggu ini, terutamanya inventori pautan silikon semasa masih belum melihat kesan yang jelas, keghairahan membeli silikon hiliran adalah terhad, pembidaan perusahaan dan superposisi penghantaran harga bahan silikon huluan terus menurun, transaksi silikon harga jatuh mendadak.

Difahamkan bahawa pada masa ini, kerugian tunai perusahaan sel silikon lebih serius, dan beberapa pengeluar terus mengurangkan pengeluaran. Menurut tinjauan cawangan Industri Silikon, minggu ini dua perusahaan terkemuka dan perusahaan bersepadu telah mengurangkan kadar operasi dengan ketara. Perusahaan bersepadu jauh lebih menjimatkan kos daripada pengeluaran sel silikon mereka sendiri, jadi mereka menggunakan faundri silikon, pengedaran berganda, perlombongan langsung dan cara operasi lain.

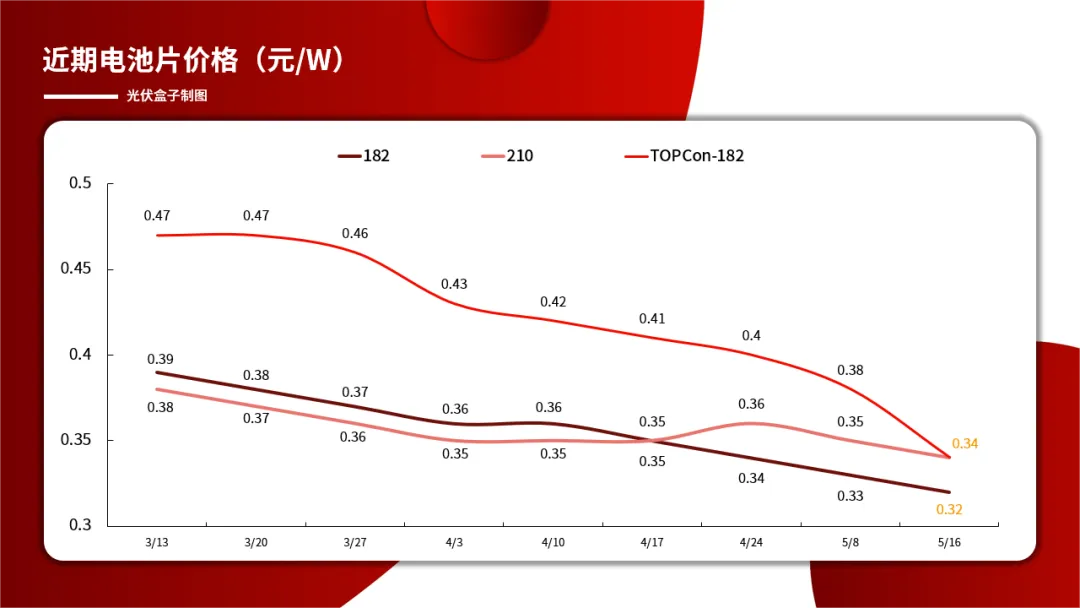

Harga Sel Terkini

Cell prices continued to fall this week, and TOPCon cell prices fell more.

At present, the price of N-type TOPCon cell has come to 0.34 RMB /W; The price of single crystal PERC182 cell came to 0.32 RMB /W, and the price of single crystal PERC210 cell came to 0.34 RMB /W.

This week, the supply pressure of the cell segment continues to increase, on the one hand, the N-type output continues to grow, on the other hand, the upstream silicon chip overfalls lead to the downstream limit price pressure, and the inventory continues to rise. In addition, the chaos in the price of silicon chips has exacerbated the discrete cost of cell chips and the confusion in the market quotation. It is understood that some manufacturers are already planning to reduce production.

Looking forward to the future trend, if the upstream price continues to overfall, it is expected that the cell price still has room to explore.

The harga terkini daripada Panel Suria

This week, the solar panel market was affected by the upstream, and the price continued to fall.

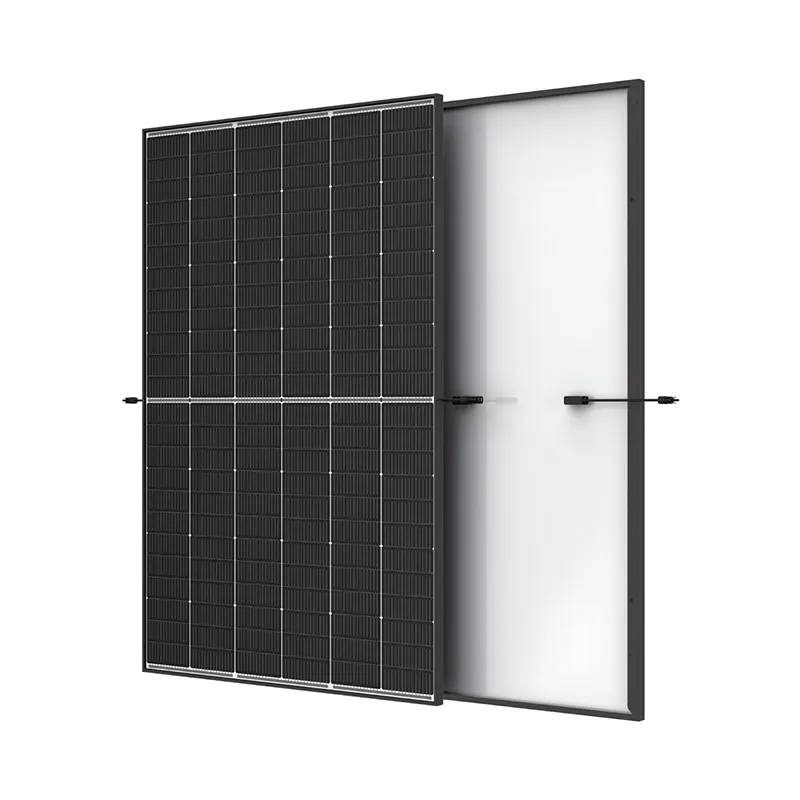

According to market data, in the distributed range this week, the mainstream trading price of first-line 182 single-sided single crystal PERC solar panels was 0.8-0.84 RMB/W, with an average price of 0.82 RMB /W; The mainstream price of 182 PERC double glass solar panels is 0.82-0.86 RMB /W, with an average price of 0.84RMB /W; The 210 series is the same price.

In terms of N-type solar panels, within the distributed range this week, the mainstream price of TOPCon solar panel orders delivered by first-line enterprises is in the range of 0.84-0.92 RMB /W, with an average price of 0.86 RMB /W; The mainstream trading price of HJT solar panel manufacturers has fallen to the range of 0.97-1.1 RMB /W, with an average price of 1 RMB /W.

Dari perspektif penawaran dan permintaan, bekalan dan permintaan keseluruhan panel solar minggu ini adalah stabil. Walau bagaimanapun, dari segi penawaran, penurunan harga huluan yang tidak rasional dan pantas telah memberi kesan yang besar ke atas sokongan sampingan kos panel solar, jadi pengeluar menyesuaikan harga; Dari segi permintaan, pendapatan projek terminal adalah lebih baik, tetapi kejatuhan berterusan harga huluan juga menyebabkan terminal meragui sama ada harga panel solar boleh stabil. Secara keseluruhan, tidak ada perubahan besar dalam kekuatan penghantaran panel solar minggu ini.

Pv box PV kumpulan pasaran hiliran berdasarkan harga transaksi panel solar pasaran teragih dalam statistik terminal, harga panduan panel solar pada minggu ketiga bulan Mei diringkaskan seperti berikut:

Catatan

1. Harga yang disebut untuk panel solar minggu ini ialah harga panduan untuk panel solar projek yang diedarkan dengan volum pembelian 1MW dari tempat, termasuk cukai tambah nilai dan pengangkutan 13% di China Timur (bukan sebagai rujukan untuk pembidaan berskala besar projek).

- 2.Harga panel solar ini adalah merujuk kepada harga transaksi pasaran kilang panel solar barisan pertama. Harga kilang panel solar barisan kedua secara amnya 0.02-0.04 RMB /W lebih murah daripada kilang panel solar barisan pertama.

3.harga panduan modul PV teragih 1MW hanya untuk pelabur teragih dan rujukan EPC

-

Solar Panel Cut Energy CostsBeritaAug.18,2025

-

Panel Solar Bifacial Boosts Energy YieldsBeritaAug.18,2025

-

Highest Monocrystalline Solar Panel Efficiency WinsBeritaAug.18,2025

-

Cost of 100 Watt Solar Panel ReducesBeritaAug.18,2025

-

Bifacial Monocrystalline Boosts YieldsBeritaAug.18,2025

-

Bi Facial Panels Boost OutputBeritaAug.18,2025