solar panel cost for 2000 sq ft house

Understanding Solar Panel Costs for a 2000 Sq Ft House

As concerns over climate change and rising energy prices grow, many homeowners are considering making the switch to solar energy. For those living in a 2000 square foot house, understanding the costs associated with installing solar panels is an essential aspect of the decision-making process. This article aims to provide insights into the various factors that affect the cost of solar panel installation and help homeowners make informed choices about their solar energy investments.

The Basics of Solar Panel Costs

The cost of solar panels can vary substantially based on several factors, including the size of the home, local energy prices, and available incentives. On average, homeowners can expect to pay between $15,000 and $30,000 for a solar panel system designed to power a 2000 sq ft house. This price range includes the cost of equipment, installation, and additional expenses such as permits and inspections.

System Size and Energy Needs

To determine the specific costs for a 2000 sq ft house, it’s important to calculate the home's energy needs. A typical home of this size may require around 8,000 to 10,000 kilowatt-hours (kWh) of electricity annually. The size of the solar array needed to meet this demand will depend on factors such as the home’s location, sunlight exposure, and energy efficiency.

Generally, a 6 kW to 9 kW solar panel system is recommended for such a home. The price of solar panels can range from $2.50 to $3.50 per watt. Therefore, if we take an average cost of $3.00 per watt, the total system installation cost could be approximately $18,000 to $27,000, excluding any applicable tax credits or incentives.

Incentives and Tax Credits

solar panel cost for 2000 sq ft house

One of the significant benefits of going solar is the availability of incentives that can help reduce upfront costs. In the United States, the federal solar tax credit allows homeowners to deduct a percentage of the costs of the solar panel system from their federal taxes. As of 2023, this credit stands at 30%. For a $20,000 solar panel system, this translates to a tax credit of $6,000, effectively lowering the overall cost to $14,000.

Additionally, many states and local governments offer their own incentives, such as rebates, performance-based incentives, and even property tax exemptions for solar energy systems. Homeowners should research what programs are available in their area to maximize savings.

Long-Term Savings and Efficiency

Investing in solar panels is not just about upfront costs; it's also about long-term savings. Solar energy can significantly reduce or even eliminate electricity bills, depending on the system size and local energy rates. Over time, the return on investment can be substantial. Homeowners may also benefit from net metering, where they receive credits for excess energy produced by their solar system, further offsetting costs.

It’s also important to consider the efficiency and lifespan of the solar panels. Most modern systems come with warranties ranging from 25 to 30 years, meaning that once the system is installed, homeowners can expect long-term energy savings without worrying about frequent replacements.

Conclusion

For homeowners with a 2000 square foot house, investing in solar panels can be a wise financial and environmental decision. While upfront costs can be significant, tax incentives and long-term energy savings can make solar energy an attractive option. By carefully evaluating energy needs, researching local incentives, and choosing the right solar provider, homeowners can harness the power of the sun and enjoy the numerous benefits of solar energy. As technology advances and installation costs continue to decline, going solar may soon be an accessible option for many more households, contributing to a sustainable future.

-

String Solar Inverter: The High-Efficiency Solution for Smart Solar EnergyNewsJul.14,2025

-

Revolutionizing Rooftop Energy with the Power of the Micro Solar InverterNewsJul.14,2025

-

Power Independence with Smart Off Grid Solar Inverter SolutionsNewsJul.14,2025

-

On Grid Solar Inverter: Powering the Future with Smart Grid IntegrationNewsJul.14,2025

-

Monocrystalline Solar Panels: High-Efficiency Power for the Future of Clean EnergyNewsJul.14,2025

-

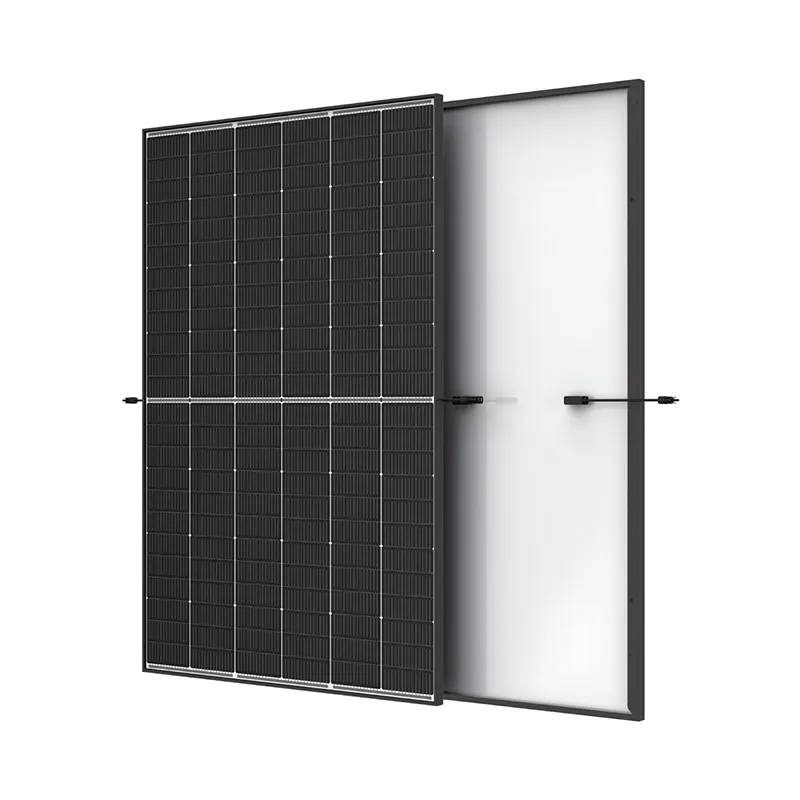

Bifacial Solar Panel: A Smarter Investment for Next-Generation Energy SystemsNewsJul.14,2025