1 solar panel price

The Impact of 1% Solar Panel Price Reduction on the Renewable Energy Market

As the world continues to grapple with the challenges posed by climate change, the renewable energy sector has emerged as a beacon of hope. Among various renewable energy sources, solar energy stands out due to its accessibility and potential for widespread adoption. A significant factor influencing the growth of solar energy is the price of solar panels. Recently, discussions have centered around the implications of a mere 1% reduction in solar panel prices. This article explores how such a price drop can have profound effects on the renewable energy market, adoption rates, and the broader economy.

The cost of solar panels has been on a decreasing trajectory for several years, thanks largely to advancements in technology, economies of scale, and increased competition among manufacturers. A 1% reduction in price may seem modest at first glance, but when viewed through the lenses of market dynamics and consumer behavior, its impact can be substantial.

The Impact of 1% Solar Panel Price Reduction on the Renewable Energy Market

The ripple effect of reduced prices extends beyond individual consumers. A 1% decrease in solar panel costs can stimulate increased installations at a larger scale, leading to greater renewable energy capacity in the market. Governments and businesses are incentivized to invest in solar farms and large-scale solar projects when costs decrease, resulting in more competitive energy prices in the long term. This competition can lead to lower energy costs for all consumers, making clean energy accessible to even more people.

1 solar panel price

Moreover, as more solar panels are installed, the need for skilled labor in the renewable energy sector will grow. This could result in job creation and economic stimulus in local communities, particularly in areas that have embraced solar as a significant part of their energy strategy. A thriving solar industry bolsters not only the green economy but also contributes to job diversification and workforce development.

In addition to direct economic impacts, a 1% decrease in solar panel prices aligns with broader environmental benefits. Affordable solar technologies can lead to increased installation rates, ultimately reducing reliance on fossil fuels. This transition is essential in reducing greenhouse gas emissions, mitigating climate change effects, and promoting energy independence. Countries that invest in renewable energy sources, such as solar, are better positioned to meet their climate action commitments and enhance their energy security.

Investors concerned with the long-term viability and profitability of renewable energy projects would also take note of a 1% price reduction. Such a decline can improve the financial feasibility of solar ventures, attracting more capital into the sector. In a market where potential returns are influenced by fluctuating costs, even minor reductions can enhance confidence in solar investments.

However, it is crucial to acknowledge that the solar panel market is not isolated. A variety of factors, including policy changes, international trade conditions, supply chain dynamics, and macroeconomic trends, also play a significant role in shaping the solar landscape. While a 1% price reduction can have positive repercussions, it must be accompanied by supportive policies and investment in infrastructure to ensure sustained growth in the sector.

In conclusion, a 1% reduction in solar panel prices might appear inconsequential at first but can serve as a catalyst for broader changes within the renewable energy market. By promoting increased adoption, enhancing economic opportunities, and contributing to environmental sustainability, even minor price shifts can drive forward the clean energy revolution. As we navigate through the complexities of global energy needs and climate challenges, every percentage point matters in the quest for a sustainable future. The renewable energy sector must capitalize on such opportunities to build momentum towards a greener, more resilient economy.

-

String Solar Inverter: The High-Efficiency Solution for Smart Solar EnergyNewsJul.14,2025

-

Revolutionizing Rooftop Energy with the Power of the Micro Solar InverterNewsJul.14,2025

-

Power Independence with Smart Off Grid Solar Inverter SolutionsNewsJul.14,2025

-

On Grid Solar Inverter: Powering the Future with Smart Grid IntegrationNewsJul.14,2025

-

Monocrystalline Solar Panels: High-Efficiency Power for the Future of Clean EnergyNewsJul.14,2025

-

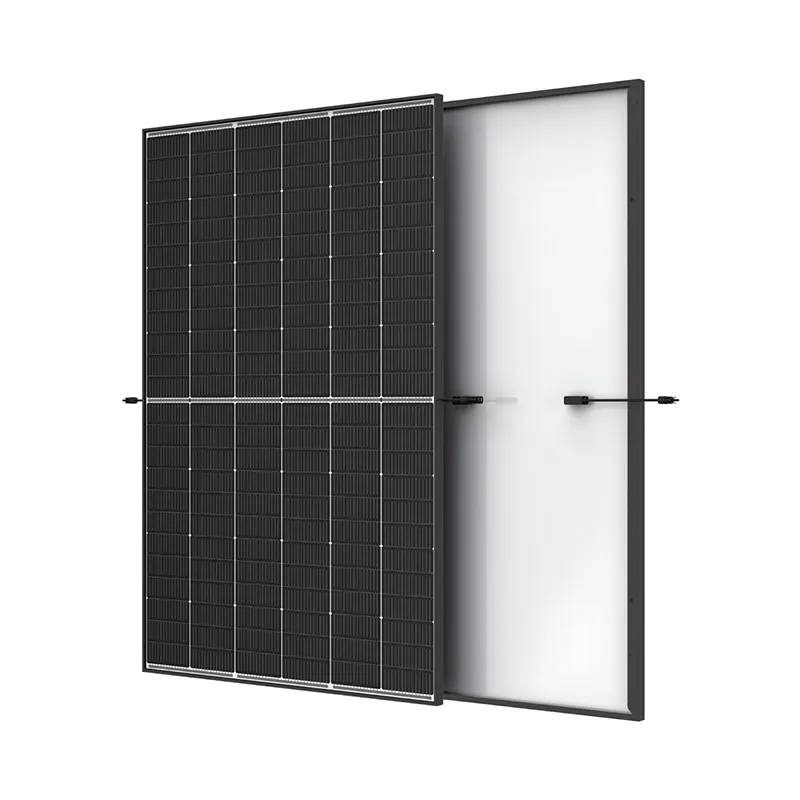

Bifacial Solar Panel: A Smarter Investment for Next-Generation Energy SystemsNewsJul.14,2025