government incentives for solar panels

Government Incentives for Solar Panels Paving the Way for Renewable Energy

As the world grapples with climate change and seeks sustainable energy sources, governments across the globe are actively promoting the use of solar panels through various incentives. These initiatives aim to reduce dependence on fossil fuels, decrease greenhouse gas emissions, and accelerate the transition to renewable energy. This article explores the different types of government incentives for solar panel installations and their impact on the renewable energy landscape.

1. Tax Credits and Deductions

One of the most effective ways governments encourage solar energy adoption is through tax credits and deductions. In the United States, for example, the Federal Investment Tax Credit (ITC) offers homeowners and businesses a significant tax credit—currently 26% of the total installation cost of solar panels. This credit incentivizes individuals to invest in solar technology, effectively reducing the upfront costs. Some states also provide additional tax credits, rebates, or exemptions from property taxes, further enhancing the financial appeal of solar investments.

2. Grants and Subsidies

Many governments offer grants and subsidies to make solar installations more financially accessible. For instance, local and state governments may provide direct financial assistance to help offset the costs involved in solar panel systems. These programs are particularly beneficial for low-income households or communities that would otherwise struggle to afford the initial investment. By lowering the barrier to entry, grants and subsidies play a critical role in increasing the adoption of solar energy among diverse populations.

3. Feed-in Tariffs and Power Purchase Agreements

Feed-in tariffs (FiTs) are payment schemes designed to encourage the generation of renewable energy. Under a FiT, individuals or businesses that install solar panels are guaranteed a fixed payment for the electricity they generate over a specific period. This arrangement provides financial certainty and supports the business case for solar investments. Similarly, Power Purchase Agreements (PPAs) allow customers to install solar panels with little or no upfront costs, as they agree to purchase the power generated at a predetermined rate, making solar energy accessible to more people.

government incentives for solar panels

4. Renewable Portfolio Standards

Renewable Portfolio Standards (RPS) require utilities to obtain a certain percentage of their energy from renewable sources, including solar. Governments enforce RPS to promote renewable energy generation and create a market for solar energy. Utilities often meet their RPS obligations by purchasing renewable energy credits (RECs) from solar panel owners. This creates a financial incentive for homeowners and businesses to install solar systems, as they can sell these credits while producing clean energy.

5. Net Metering

Net metering is another crucial incentive for solar energy users. This policy allows homeowners with solar panels to offset their energy consumption by feeding excess electricity back into the grid. Utility companies then credit these homeowners for their contributions, effectively lowering their electricity bills. By ensuring that solar users can benefit from any excess energy they generate, net metering makes solar installations more financially viable and encourages more people to adopt solar technologies.

6. Educational Programs and Technical Support

Governments also provide educational programs and technical support to facilitate solar panel adoption. By offering resources that help consumers understand the benefits and workings of solar energy, governments empower individuals to make informed decisions about their energy source. Workshops, online resources, and consultations with solar experts can demystify the installation process and financial implications of solar energy, further driving interest and adoption.

Conclusion

Government incentives for solar panels are crucial in accelerating the shift towards renewable energy. Through a combination of tax credits, grants, subsidies, feed-in tariffs, net metering, and educational initiatives, governments can reduce the financial burden associated with solar energy installations. These incentives not only help individuals and businesses transition to cleaner energy solutions but also contribute to the global effort to combat climate change. As these programs evolve and expand, the adoption of solar panels is likely to continue growing, leading to a more sustainable and energy-independent future.

-

String Solar Inverter: The High-Efficiency Solution for Smart Solar EnergyNewsJul.14,2025

-

Revolutionizing Rooftop Energy with the Power of the Micro Solar InverterNewsJul.14,2025

-

Power Independence with Smart Off Grid Solar Inverter SolutionsNewsJul.14,2025

-

On Grid Solar Inverter: Powering the Future with Smart Grid IntegrationNewsJul.14,2025

-

Monocrystalline Solar Panels: High-Efficiency Power for the Future of Clean EnergyNewsJul.14,2025

-

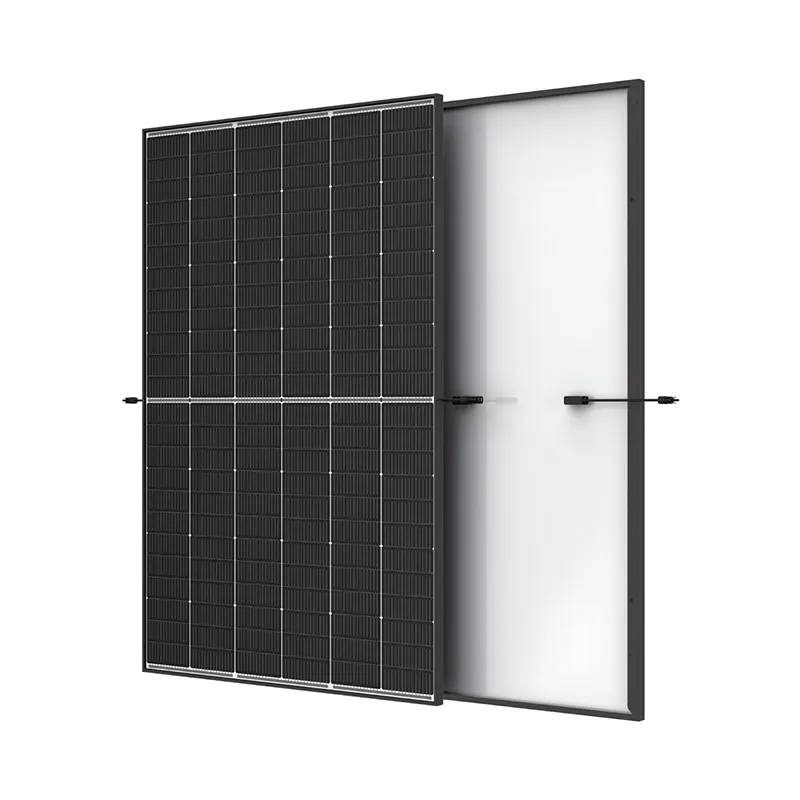

Bifacial Solar Panel: A Smarter Investment for Next-Generation Energy SystemsNewsJul.14,2025