solar panel system cost

Understanding Solar Panel System Costs

As the world increasingly turns its attention to renewable energy sources, solar power has emerged as a leading contender. Solar panel systems have become an attractive option for homeowners and businesses alike, thanks to decreasing costs, environmental benefits, and government incentives. However, understanding the overall costs associated with a solar panel system is essential for making informed decisions.

The cost of a solar panel system can vary greatly depending on several factors. On average, the price of installing solar panels ranges from $15,000 to $25,000 for a typical residential system before any tax credits or incentives are applied. This price includes equipment costs such as solar panels, inverters, mounting hardware, and installation labor. However, it's essential to note that these figures can fluctuate significantly based on location, system size, and the specific technology used.

Understanding Solar Panel System Costs

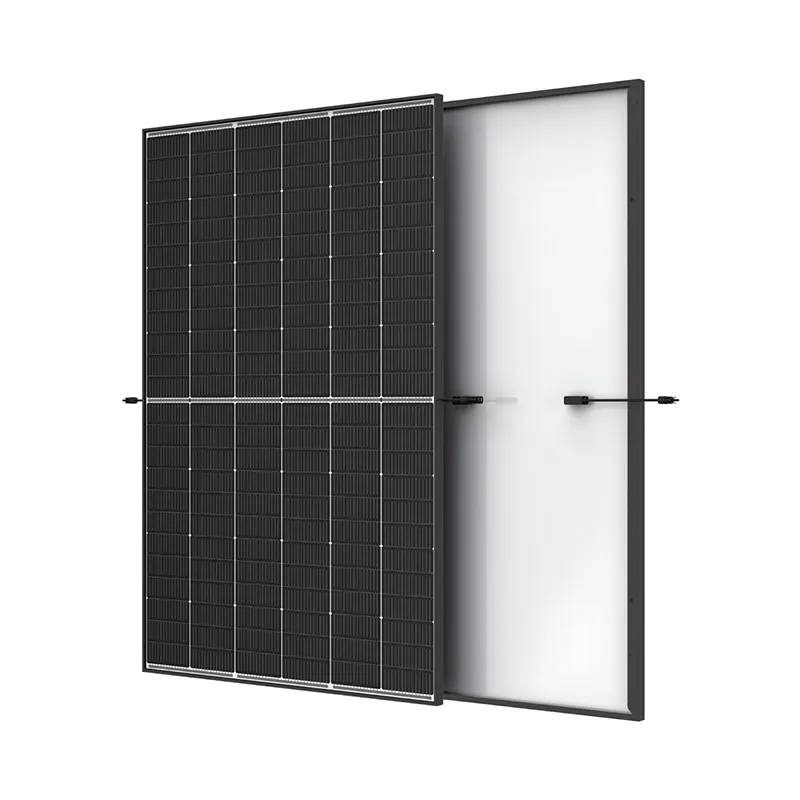

Another critical consideration is the type of solar panels chosen. There are primarily two types of solar panels available on the market monocrystalline and polycrystalline. Monocrystalline panels tend to be more efficient and space-saving, but they are also typically more expensive. Conversely, polycrystalline panels offer a more budget-friendly option but may require more space and yield slightly less energy compared to their monocrystalline counterparts. Choosing the right type of panel will depend on your budget and the specific installation scenario.

solar panel system cost

Installation costs also play a significant role in the overall expense of a solar panel system. Costs can vary based on geographical location, local labor rates, and the complexity of the installation. For example, installing solar panels on a sloped roof may be more challenging and, subsequently, more expensive than installing them on a flat roof. Homeowners should look for licensed and experienced solar installers to ensure the system is correctly installed and operating efficiently.

Government incentives and rebates can considerably reduce the total cost of a solar panel system. In the United States, the federal solar tax credit (Investment Tax Credit or ITC) allows homeowners to deduct a percentage of their solar installation costs from their federal taxes. As of 2023, this credit stands at 30%, making solar energy more accessible. Additionally, various state and local programs may offer incentives, rebates, or net metering policies that further enhance the financial appeal of solar investments.

Lastly, financing options should also be considered. Many homeowners are unable to pay for solar panels upfront and therefore look into financing options such as solar loans, leases, or power purchase agreements (PPAs). These options can help make solar energy more accessible while allowing users to manage their budget effectively.

In conclusion, while the upfront costs of a solar panel system can seem intimidating, understanding the various contributing factors can help potential users make well-informed decisions. Factors such as system size, type of panels, installation complexity, available incentives, and financing options all influence the total cost. With solar power becoming increasingly affordable and accessible, investing in a solar panel system can be a worthwhile endeavor, paving the way for both energy savings and a sustainable future.

-

Understanding the Advantages of Solar String Inverters for Your Energy SystemNewsApr.29,2025

-

Choosing the Right PV Inverter: A Comprehensive GuideNewsApr.29,2025

-

The Future of Solar Power: Exploring Bifacial Solar PanelsNewsApr.29,2025

-

The Complete Guide to Solar Panels: Efficiency, Cost, And InstallationNewsApr.29,2025

-

The Best Options for Efficiency and Cost-EffectivenessNewsApr.29,2025

-

Harnessing the Power of Off-Grid Solar Inverters for Energy IndependenceNewsApr.29,2025