Calculating the Expenses for Installing Solar Panels on Your Roof

The Cost to Add Solar Panels to Your Roof

As the world increasingly shifts toward renewable energy sources, the interest in solar panels has soared. Homeowners looking for both environmental benefits and potential savings on energy bills often consider installing solar panels on their roofs. However, understanding the costs involved in this decision is essential for making an informed choice.

Initial Costs

The initial costs of installing solar panels can vary significantly depending on several factors. On average, the cost to add solar panels to a residential roof ranges from $15,000 to $30,000 before any tax credits or incentives. This estimate typically includes the cost of the solar panels, installation, inverters, and all necessary equipment. Factors such as the size of your roof, the type of solar panels you choose, and your geographical location can all influence the final price.

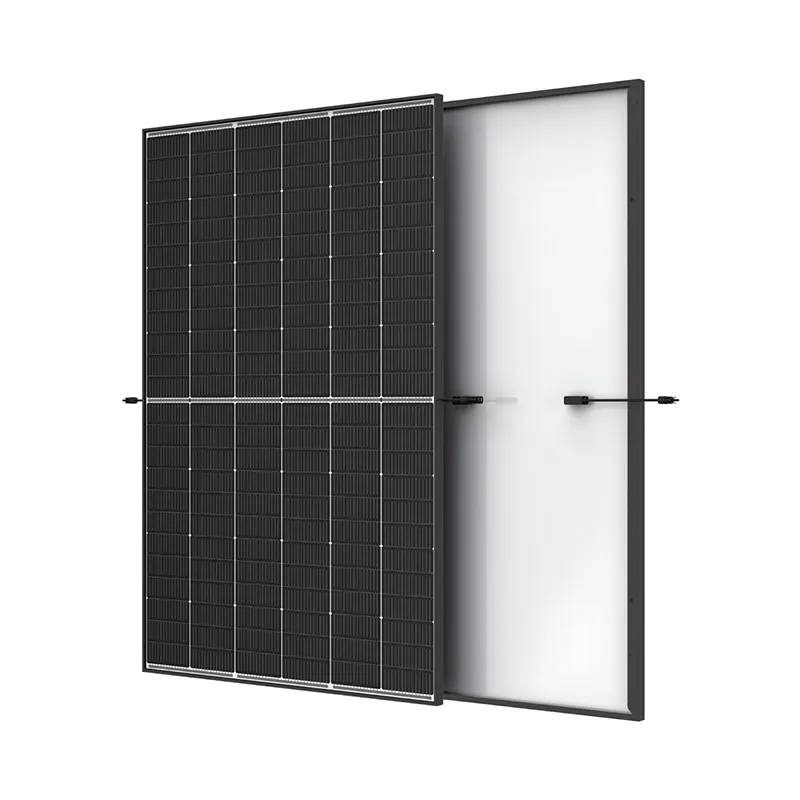

One of the most significant factors impacting the cost is the type of solar panels selected. There are generally three types monocrystalline, polycrystalline, and thin-film. Monocrystalline panels are usually the most efficient but also the most expensive. They harness more energy per square foot, making them an excellent option for homes with limited roof space. Polycrystalline panels, while slightly less efficient, are more affordable and offer a good balance between cost and performance. Thin-film panels are the least efficient and least expensive but are typically used in large-scale installations where space is not a concern.

Financing Options

To alleviate the financial burden, homeowners have various financing options available. Many companies offer solar loans that allow you to pay for the system over time. Some homeowners choose to lease their solar panels, paying a monthly fee to use the panels without owning them outright. In some cases, power purchase agreements (PPAs) allow homeowners to pay for the electricity produced by the solar panels at a predetermined rate, which is often lower than their local utility rates.

cost to add solar panels to roof

Government incentives can also significantly reduce the cost of solar installations. The federal solar tax credit (Investment Tax Credit, or ITC) allows you to deduct a portion of the installation cost from your federal taxes. As of 2023, this credit is set at 30% but is scheduled to decrease in subsequent years. Many states and local governments also offer additional incentives, rebates, or property tax exemptions that can help make solar panels more affordable.

Long-Term Savings

While the upfront costs can be daunting, many homeowners find that the long-term savings on electricity bills make the investment worthwhile. Depending on the size of the system and energy consumption, homeowners can save thousands of dollars over the lifespan of the solar panels—typically 25 to 30 years. Solar energy can significantly reduce, or even eliminate, monthly electricity bills, providing financial relief in the long run.

Additionally, adding solar panels can increase your home’s market value. Homes equipped with energy-efficient features, such as solar panels, are often more appealing to buyers and can command higher sales prices. Studies have shown that homes with solar panels sell for approximately 4% more than comparable homes without them.

Conclusion

In summary, the cost to add solar panels to your roof involves several factors, including the initial installation cost, financing options, and potential long-term savings. While the upfront investment can seem high, the combination of energy savings, government incentives, and increased home value makes solar panels an attractive option for many homeowners. As technology improves and costs continue to decline, solar energy represents a promising path toward sustainable living and energy independence. If you’re considering making the switch, it’s advisable to consult with a solar energy expert to explore your options and determine the best solution for your home and budget.

-

String Solar Inverter: The High-Efficiency Solution for Smart Solar EnergyNewsJul.14,2025

-

Revolutionizing Rooftop Energy with the Power of the Micro Solar InverterNewsJul.14,2025

-

Power Independence with Smart Off Grid Solar Inverter SolutionsNewsJul.14,2025

-

On Grid Solar Inverter: Powering the Future with Smart Grid IntegrationNewsJul.14,2025

-

Monocrystalline Solar Panels: High-Efficiency Power for the Future of Clean EnergyNewsJul.14,2025

-

Bifacial Solar Panel: A Smarter Investment for Next-Generation Energy SystemsNewsJul.14,2025