Understanding the Costs of Solar Panels for Residential Installations

The Cost of Solar Panels for Homes An Investment in Sustainability

As concerns about climate change and energy costs continue to rise, many homeowners are turning to solar power as an alternative energy source. However, one of the most pressing questions for potential buyers is how much do solar panels for homes cost? Understanding the various factors that influence solar panel pricing can help you make an informed decision and assess whether investing in this renewable energy is right for you.

Initial Costs of Solar Panels

The average cost of installing solar panels on a residential property in the United States typically ranges from $15,000 to $25,000 before any incentives or rebates. This includes the cost of the solar panels themselves, as well as installation fees, permits, and other associated expenses. On average, homeowners may expect to pay about $3 to $5 per watt of solar capacity installed. In addition to the panels, a complete solar system often includes hardware like inverters, racking systems, and battery storage (if applicable).

Factors Affecting the Cost

1. System Size The size of your solar system is one of the most significant factors affecting the overall cost. Larger systems, which can generate more electricity, will naturally cost more upfront but can lead to greater long-term savings on your energy bills.

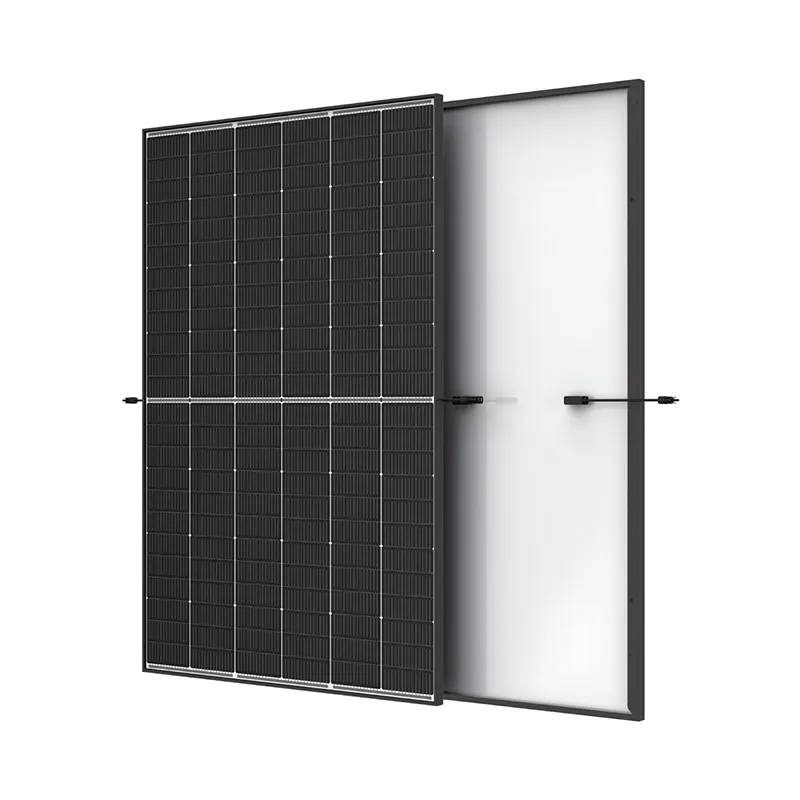

2. Panel Type There are several types of solar panels available, including monocrystalline, polycrystalline, and thin-film panels. Monocrystalline panels, known for their efficiency and space-saving design, tend to be the most expensive. Polycrystalline panels are generally less costly but may take up more space. Thin-film panels, while often more affordable, may not provide the same efficiency ratings.

3. Installation Costs Labor costs can vary significantly depending on your location and the complexity of the installation. Regions with high living expenses may see higher installation costs. Additionally, if your roof requires repairs or structural enhancements before installation, these costs will add to the total.

solar panels for home cost

4. Incentives and Rebates Many states and local governments offer incentives to encourage solar adoption. Federal tax credits, such as the Solar Investment Tax Credit (ITC), allow homeowners to deduct a portion of their solar installation costs from their federal taxes. Financial incentives can drastically reduce the overall upfront expenditure, making solar panels more accessible.

5. Financing Options Paying for solar panels outright may not be feasible for everyone. Financing options such as solar loans, leases, and power purchase agreements (PPAs) can provide opportunities for homeowners to install solar systems without a large initial investment. Each financing method has its pros and cons, and depending on your financial situation, one may be more beneficial than the others.

Return on Investment

While the initial cost of solar panels can be substantial, it is essential to consider the long-term savings and returns. Homeowners can see a reduction in their electricity bills, often up to 70% or more, depending on the efficiency and size of their systems. The payback period for solar panel systems typically averages between 5 to 10 years, after which most homeowners benefit from free electricity during the lifespan of the panels, which can last 25 years or more.

Furthermore, many homeowners experience an increase in property value after installing solar panels, making it a wise investment in both energy savings and home equity.

Conclusion

The decision to invest in solar panels for your home is multifaceted and involves understanding both the immediate costs and the long-term benefits. With various factors affecting pricing, it is advisable to gather multiple quotes from certified installers and keep an eye on local incentives. Transitioning to solar not only contributes to a cleaner environment, but it can also lead to significant savings on energy costs and an increase in home value. Ultimately, solar panels offer a sustainable and economically sound investment for the future.

-

String Solar Inverter: The High-Efficiency Solution for Smart Solar EnergyNewsJul.14,2025

-

Revolutionizing Rooftop Energy with the Power of the Micro Solar InverterNewsJul.14,2025

-

Power Independence with Smart Off Grid Solar Inverter SolutionsNewsJul.14,2025

-

On Grid Solar Inverter: Powering the Future with Smart Grid IntegrationNewsJul.14,2025

-

Monocrystalline Solar Panels: High-Efficiency Power for the Future of Clean EnergyNewsJul.14,2025

-

Bifacial Solar Panel: A Smarter Investment for Next-Generation Energy SystemsNewsJul.14,2025