Bifacial vs Monofacial Solar Cost Comparison, Efficiency Gains

- The Rising Cost-Efficiency Battle: Current Solar Market Dynamics

- Technical Showdown: How Dual-Surface Technology Creates Advantages

- Manufacturer Face-Off: Performance and Pricing Compared

- Custom Solutions: Matching Technology to Installation Environments

- Application Casebook: Real-World Energy Yield Comparisons

- Economic Analysis: Lifetime Value and Payback Periods

- Installation Best Practices: Maximizing Bifacial Panel Potential

(bifacial vs monofacial)

Understanding the bifacial vs monofacial

solar panel cost equation in today's market

Current solar market data reveals a narrowing price gap between single-surface and dual-surface technologies. Five years ago, premium bifacial modules carried a 15-20% cost premium over comparable monofacial panels. As of 2023 Q2, that difference has compressed to just 8-12% according to Solar Energy Industries Association reports. Driving this change are scaled manufacturing of double-glass panels and improved frameless mounting techniques.

The increased adoption of n-type silicon substrates affects market positioning. Over 40% of new utility-scale installations now deploy bifacial technology according to Wood Mackenzie data. Residential adoption trails at approximately 11%, but shows an accelerating adoption curve. Commercial energy buyers cite the 8-12% average yield improvement as justification despite higher upfront costs.

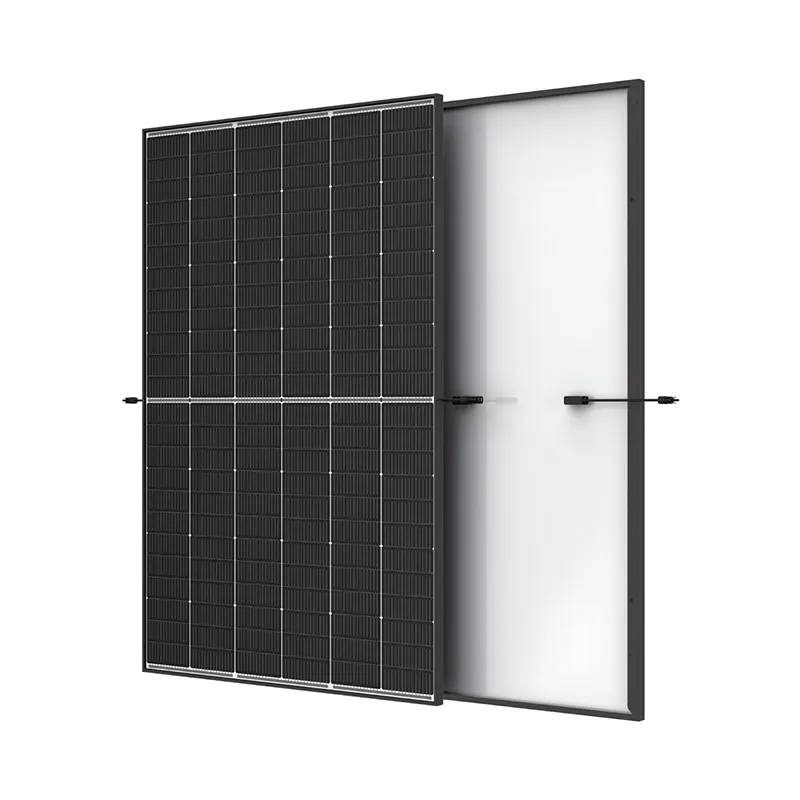

Technical Showdown: How Dual-Surface Technology Creates Advantages

Conventional monofacial panels capture photons exclusively on their front surface. Bifacial panels utilize advanced cell architecture to collect both direct sunlight and reflected albedo radiation. This dual-harvest capability generates measurable efficiency advantages:

- Albedo Utilization converts reflected light contributions that monofacial modules ignore

- Temperature Coefficients averaging -0.29%/°C outperform monofacial equivalents (-0.39%/°C)

- Higher Shade Tolerance through advanced bypass diode arrangements minimizes hotspot risks

Installation methodology significantly impacts bifacial panel performance. The technology gains advantage when elevated over reflective surfaces rather than flush-mounted. Optimal tilt angles vary by latitude but consistently exceed monofacial installations.

| Parameter | Monofacial Standard | Bifacial Advantage |

|---|---|---|

| Optimal Tilt Angle | Location latitude | Latitude + 5-10° |

| Installation Height | 0-30cm | 1-1.5m recommended |

| Required Ground Coverage | 90-100% | 60-70% with clearance |

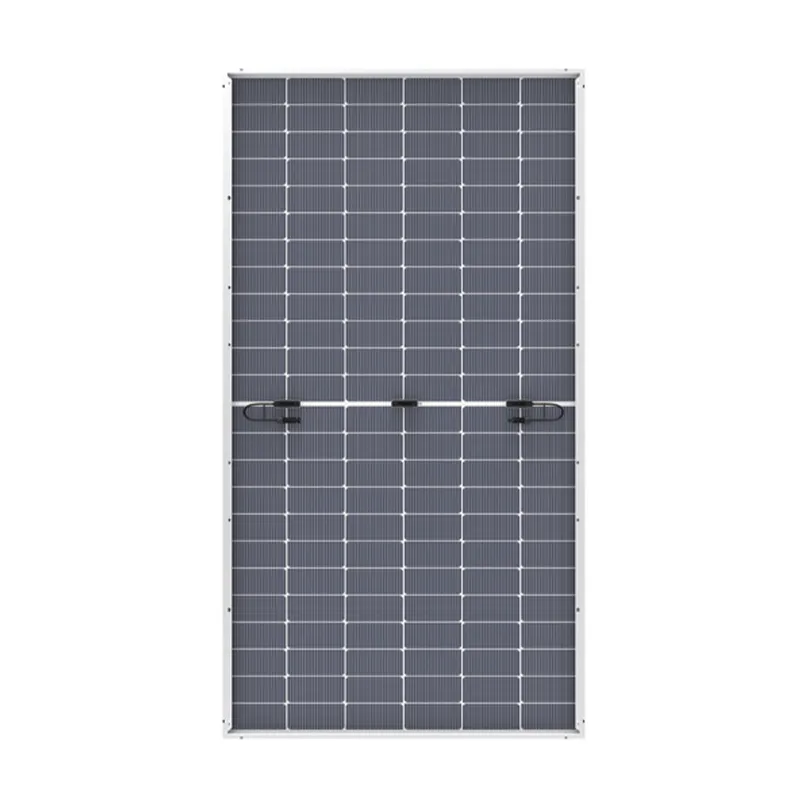

Manufacturer Face-Off: Performance and Pricing Compared

Leading manufacturers offer distinct approaches to panel bifacial vs monofacial designs. Canadian Solar reports a 13% price premium for their bifacial BiHiKu line over equivalent monofacial panels. Yet field results show 11-18% greater generation in utility applications. Trina Solar's Vertex series demonstrates similar price-performance differentials.

| Manufacturer | Bifacial Model | Monofacial Equivalent | Power Output Difference | Price Premium (%) |

|---|---|---|---|---|

| Jinko Solar | Tiger Pro 72HC Bifacial | Tiger Pro 72HC Mono | +10-15% | 9.5% |

| LONGi Solar | Hi-MO 5 Bifacial | Hi-MO 4 Monofacial | +13-21% | 12.2% |

| Hanwha Q CELLS | Q.PEAK DUO BLK-G10+ | Q.PEAK DUO BLK ML-G10+ | +8-11% | 7.8% |

Custom Solutions: Matching Technology to Installation Environments

Specific installation conditions dictate whether monofacial or bifacial technology delivers superior ROI. Ground-mounted arrays achieve the strongest bifacial advantage when constructed over highly reflective surfaces like concrete (23% albedo) or light gravel (25% albedo). Energy gains diminish significantly over grass (15% albedo) or dark surfaces.

Residential applications require careful assessment. Roof installations typically gain only 5-7% additional yield from bifacial modules unless special reflective membranes are installed. Commercial installations with parapets achieve more significant gains. Agricultural dual-use projects consistently favor bifacial configurations.

Application Casebook: Real-World Energy Yield Comparisons

Minnesota's 62MW North Star Solar demonstrates measurable bifacial advantages. Installers tracked identical quantities of monofacial and bifacial Jinko panels for 18 months. The bifacial array delivered a consistent 12.4% higher output despite Minnesota's snowy winters reducing albedo effects.

Conversely, Florida rooftop installations tell a different story. Tampa industrial park monitoring revealed only 5.2% improvement with bifacial modules due to flush roof mounting and HVAC equipment obstructions. These real-world findings reinforce that installation quality equals technology selection in importance.

Economic Analysis: Lifetime Value and Payback Periods

Levelized Cost of Energy (LCOE) analysis reveals why monofacial vs bifacial solar decisions vary by application. Using NREL benchmarks, utility-scale bifacial installations achieve LCOE of $24.80/MWh versus $28.30/MWh for monofacial equivalents. This 12.4% cost advantage assumes optimal installation conditions.

Residential payback periods show greater complexity. Bifacial systems average 7.1 years ROI versus 6.3 years for monofacial in typical suburban installations. However, the additional energy generation over 25 years delivers $3,800 greater lifetime value per 6kW system.

Monofacial vs bifacial solar requires site-specific implementation strategies

Deployment strategies significantly influence technology outcomes. Bifacial arrays achieve maximum output when oriented north-south at proper elevation for reflection capture. Tracking systems amplify their advantage - single-axis trackers boost bifacial energy harvest by 27-35% over fixed installations. Monofacial panels gain only 18-25% improvement with tracking.

Maintenance protocols diverge between technologies. Though bifacial glass-glass construction withstands higher mechanical stress, back-surface cleaning becomes critical. Field monitoring indicates quarterly rear-surface cleaning maintains energy advantage, while monofacial arrays show minimal improvement with more frequent washing. The final installation decision must balance site conditions with long-term operational commitment.

(bifacial vs monofacial)

FAQS on bifacial vs monofacial

Q: What is the cost difference between bifacial and monofacial solar panels?

A: Bifacial panels typically cost 10-20% more upfront due to advanced technology. However, they generate higher energy yields, often offsetting the expense over time. Installation variations can affect final expenses.Q: How do panel bifacial vs monofacial technologies work?

A: Bifacial panels capture sunlight from both sides using a transparent backsheet. Monofacial panels only use the front surface for energy production. This design difference leads to higher efficiency in bifacial versions under reflective conditions.Q: Monofacial vs bifacial solar: which offers better long-term value?

A: Bifacial solar panels often provide superior long-term returns in high-albedo environments like snowy areas. Monofacial panels are more affordable initially but yield less energy. Choose based on site-specific factors like ground reflection.Q: Are bifacial solar panels worth the investment over monofacial ones?

A: For installations with ample reflective surfaces, bifacial panels justify the cost through increased electricity generation. Monofacial panels may be more cost-effective in standard rooftop setups. Evaluate your location's solar potential first.Q: Which performs better in diverse weather: monofacial or bifacial solar panels?

A: Bifacial panels excel in varied conditions by leveraging reflected light, boosting output by up to 30%. Monofacial panels perform reliably but are less adaptable to indirect light. Energy gains depend on surface albedo and installation angles.-

String Solar Inverter: The High-Efficiency Solution for Smart Solar EnergyNewsJul.14,2025

-

Revolutionizing Rooftop Energy with the Power of the Micro Solar InverterNewsJul.14,2025

-

Power Independence with Smart Off Grid Solar Inverter SolutionsNewsJul.14,2025

-

On Grid Solar Inverter: Powering the Future with Smart Grid IntegrationNewsJul.14,2025

-

Monocrystalline Solar Panels: High-Efficiency Power for the Future of Clean EnergyNewsJul.14,2025

-

Bifacial Solar Panel: A Smarter Investment for Next-Generation Energy SystemsNewsJul.14,2025