roof solar panels cost

The Cost of Roof Solar Panels A Comprehensive Guide

As the world shifts towards more sustainable energy solutions, the popularity of solar panels, particularly roof-mounted solar panels, has surged. Homeowners are increasingly considering this eco-friendly option, not just for its environmental benefits, but also for potential long-term savings on energy costs. However, understanding the cost associated with installing roof solar panels is crucial for making an informed decision.

Initial Investment

The cost of roof solar panels can vary significantly based on several factors, including the size of the system, the type of panels chosen, installation costs, and the geographical location of the property. On average, for a residential solar panel system, homeowners can expect to spend between $15,000 to $25,000 before incentives. This range typically reflects a system size of 6 to 10 kilowatts, which can cover a considerable portion of a household's energy needs.

Factors Affecting Cost

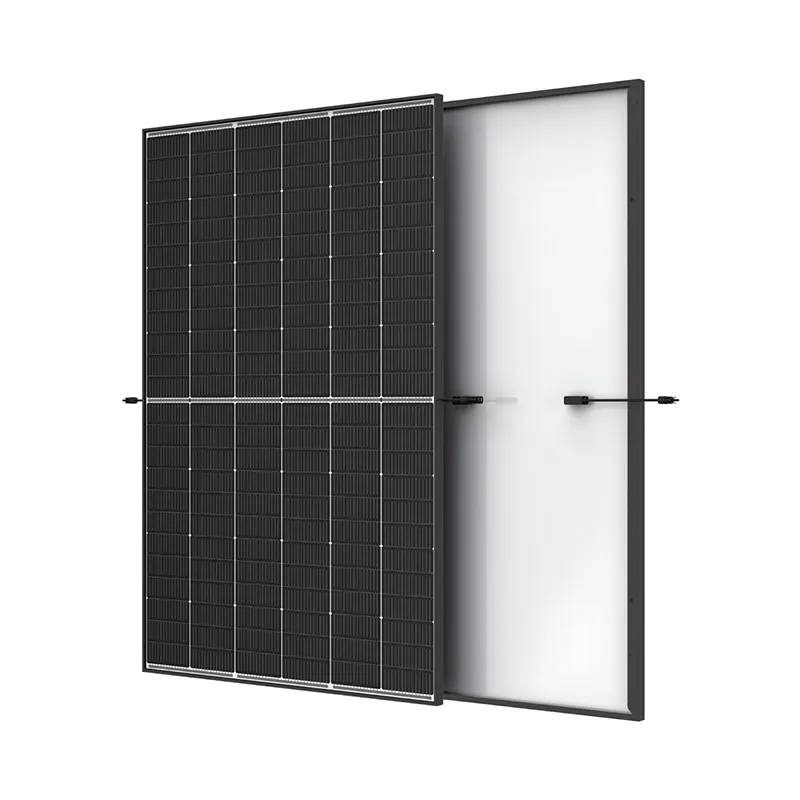

1. Type of Solar Panels There are generally two types of solar panels to choose from monocrystalline and polycrystalline. Monocrystalline panels are often more efficient and take up less space but tend to be more expensive. Polycrystalline panels are more affordable but can require more space since they are less efficient. The choice between these types can significantly affect the overall cost.

2. System Size The size of the solar panel system impacts the cost directly. Larger systems which generate more electricity will have higher upfront costs but can lead to greater savings on energy bills over time.

3. Installation Costs Installation costs can vary based on the complexity of the installation, local labor rates, and the installer chosen. It’s essential to obtain multiple quotes from certified solar installation companies to find the most competitive prices.

roof solar panels cost

4. Geographic Location Solar panel costs can also be influenced by regional differences. States with more sunlight tend to yield better energy production and savings, but installation costs may also be higher in those areas due to increased demand.

Tax Credits and Incentives

One of the most attractive aspects of investing in roof solar panels is the availability of tax credits and incentives. In the United States, the federal solar investment tax credit (ITC) allows homeowners to deduct a significant percentage of the installation costs from their federal taxes. Currently, this credit is set at 26% for systems installed through 2022 and is scheduled to decrease in subsequent years. Many states and local governments also offer additional rebates and incentives, further reducing the overall investment cost.

Long-Term Savings

While the initial investment for roof solar panels may seem substantial, the long-term savings can be significant. Homeowners can expect to save thousands on electricity bills over the lifespan of the system, which typically ranges from 25 to 30 years. Moreover, solar panels increase property values; homes equipped with solar energy systems can sell for more than those without.

Conclusion

Investing in roof solar panels represents not only a commitment to sustainable living but also a savvy financial decision for many homeowners. While the upfront costs can be daunting, taking into account potential savings, tax incentives, and the long-term benefits usually outweigh these initial expenses. As technology advances and costs continue to decline, more homeowners will likely adopt this renewable energy solution. If you're considering making the switch to solar, it’s crucial to conduct thorough research and consult with professionals to understand all aspects of the investment. With the right preparation and information, you can enjoy the numerous benefits of solar energy, both for your wallet and the planet.

-

String Solar Inverter: The High-Efficiency Solution for Smart Solar EnergyNewsJul.14,2025

-

Revolutionizing Rooftop Energy with the Power of the Micro Solar InverterNewsJul.14,2025

-

Power Independence with Smart Off Grid Solar Inverter SolutionsNewsJul.14,2025

-

On Grid Solar Inverter: Powering the Future with Smart Grid IntegrationNewsJul.14,2025

-

Monocrystalline Solar Panels: High-Efficiency Power for the Future of Clean EnergyNewsJul.14,2025

-

Bifacial Solar Panel: A Smarter Investment for Next-Generation Energy SystemsNewsJul.14,2025